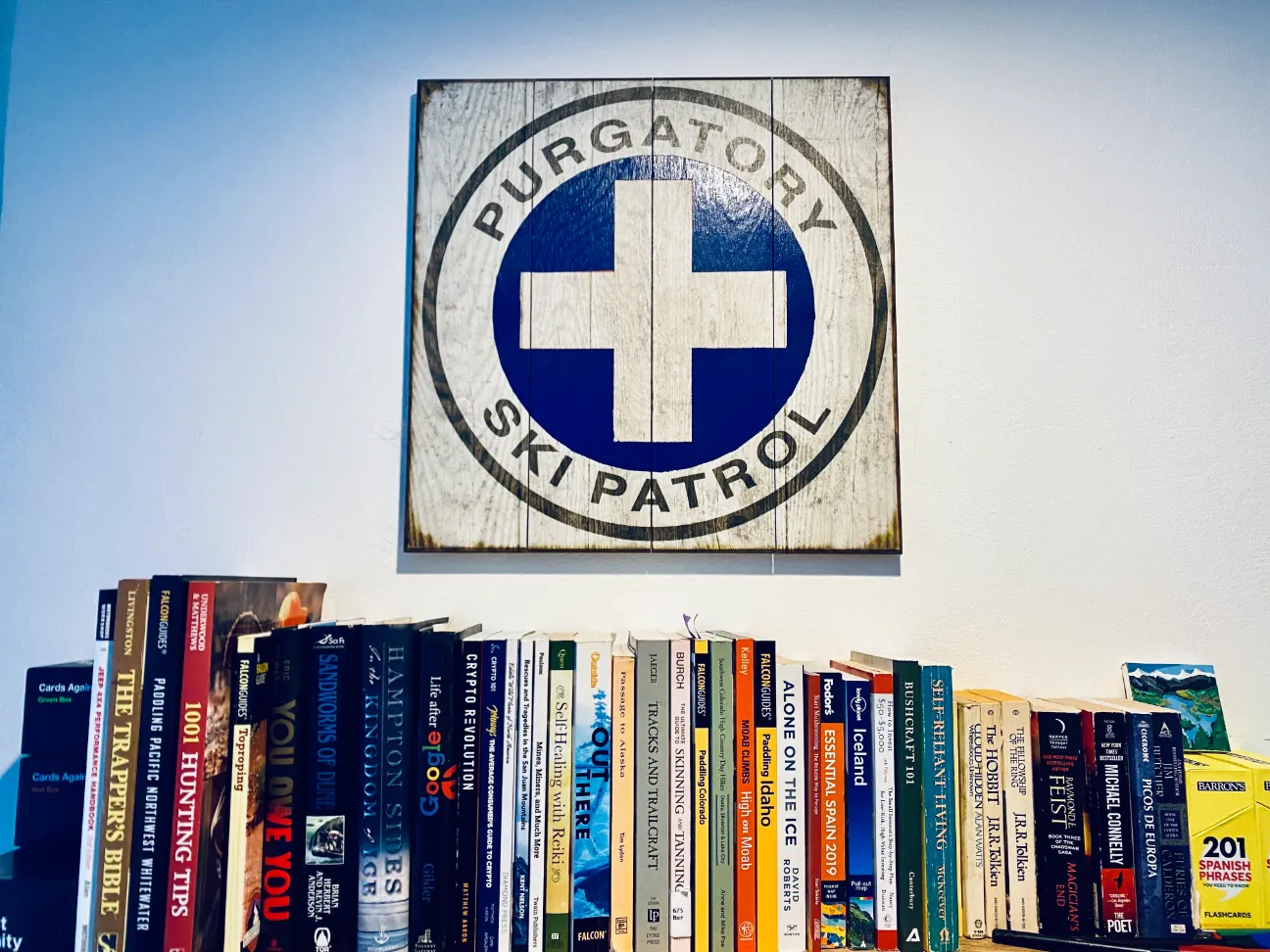

Hi! My name is Elizabeth, and I’ve been self-employed for nearly a decade. That means I must find creative retirement methods since I won’t get a pension or 401k. One of the ways I’ve generated income is by renting out my condo at Purgatory Ski Resort in Durango, CO, on Airbnb. I’ve been an Airbnb Superhost for over four years and have managed 5+ rentals. In this blog, I will teach you how to start an Airbnb and, more importantly, how to make it successful.

10 Steps to Starting an Airbnb Business

This helpful guide will give you all the information you need to become a successful Airbnb business owner.

How to Become a Host for Airbnb

I’ll cover everything from creating listings and setting prices to interacting with guests and providing amenities. By the end of this guide, you’ll be well-equipped to earn some extra income on Airbnb. Let’s dive in!

1. Rental Property Selection

When selecting an Airbnb property, there are several factors to consider.

- First, research the area in which you plan to invest, determining if it is a tourist destination, has a strong economy and business climate, and has few restrictions on Airbnb rentals.

- Identify who your rental market will be and whether it will be vacationers, business travelers, or both.

At my Purgatory Ski Resort condo, I determined that my target demographic is couples in their 20s and 30s with disposable income and no children who like skiing and hiking. My second target demographic is families of 4 or fewer looking for budget-friendly accommodations and interested in exploring the mountains with their family or going on a family ski vacation at Purgatory. My third demographic is remote workers looking to explore the area for 1-3 months. My condo is the perfect spot for both demographics because there is enough space to sleep four, and it has a kitchen and other comfortable amenities for long-term stays.

steps to starting an airbnb business

(Unexpected costs like leaks will happen, so be prepared!)

2. Investment & Operating Costs for Your Vacation Rental Business

Starting an Airbnb business involves investment and operating costs that investors should consider before taking the plunge.

When purchasing a property, investors should account for costs such as insurance, HOA, taxes, utilities, and mortgage (if applicable). Additionally, recurring expenses are associated with running an Airbnb business, such as permits, management fees, cleaning services, marketing, and remodeling. Budgeting for linen and towel costs, amenities and toiletries, and outfitting the property is also essential.

Investors should budget for maintenance, repairs, and additional marketing expenses to stand out. As with any new business venture, it’s essential to research the most profitable markets and determine what type of property you can afford and any necessary remodeling and repairs.

What I Did

I bought a condo at Purgatory Ski Resort in 2018 as my first home without an FHA and put 10% down. The apartment cost $121,000, fully furnished, and I secured a 7% interest rate. In 2020, I refinanced the condo at 2.3%, and my monthly mortgage cost is now only $565. My condo costs, including HOA and utilities, are around $1,200 in the winter and $1,100 in the summer.

Breakdown of My Costs

- $565: Mortgage, property taxes, insurance, etc.

- $418: HOA (“snow removal,” water, sewer, general condo maintenance)

- $40-160: Electricity. Heating the condo in the winter costs a lot, but without A/C, my electricity costs are minimal in the summer months.

- $120: Starlink Internet. My condo does not have fiber optics, so I opted for a Starlink Dish so my guests can stream fast and work from home. It’s a great amenity for my Airbnb guests.

3. Startup Costs

Here’s a table outlining the startup costs for an Airbnb business:

|

Startup Costs |

Estimated Range |

|

Purchase Cost |

Depends on property |

|

Insurance |

Minimum $500 |

|

Furniture Cost |

$2,000 – $6,000 |

|

Utilities and Subscriptions |

$40 – $470 monthly |

|

Home Outfitting |

$200 – $500 |

|

Consumable Goods |

$50 and up |

|

Services (e.g., photographer) |

$100 and up |

The actual costs may vary based on individual circumstances and specific property requirements.

4. Short Term Rental Licenses and Permits

What licenses and permits are needed for an Airbnb business? Here is a table listing the licenses and permits that may be needed for an Airbnb business:

|

Licenses and Permits |

Requirements and Considerations |

|

Business License |

The need for a business license can vary depending on the city or region where the Airbnb business is operated [6][8]. |

|

Short-Term Rental Permit |

Some cities or jurisdictions may require hosts to obtain a specific short-term rental permit or license to operate an Airbnb business [8] legally. |

|

Zoning Compliance |

Checking and complying with zoning regulations is essential to ensure that the property is legally permitted for short-term rental or home-sharing activities [6][8]. |

|

Health and Safety Inspections |

Certain jurisdictions may require health and safety inspections to ensure that the property meets specific standards for short-term rentals. Compliance with fire safety codes, building standards, and occupancy limits may be necessary [4][8]. |

|

Tourist Tax or Occupancy Tax |

Some cities or regions impose tourist, occupancy, or transient occupancy taxes on short-term rental accommodations. Hosts may be required to collect and remit these taxes to the appropriate tax authorities [4][8]. |

|

Other Permits or Licenses (if applicable) |

Additional permits or licenses may be required depending on the location and the nature of the Airbnb business. These can include permits for serving food, and alcohol, or conducting specific activities such as guided tours or transportation services [8]. |

The requirements can vary depending on the specific location and applicable laws and regulations.

Airbnb In CA (California)

In California, regulations and rules regarding Airbnb vary by city and county. These rules often aim to maintain affordable housing and preserve the local culture [1]. Here are some key considerations and guidelines regarding Airbnb in California:

- Short-term rentals in California are generally subject to taxation. Hosts should understand their tax obligations and consult an accountant to optimize deductions and ensure proper tax preparation. The Transient Occupancy Tax (TOT) applies to almost all short-term rental properties in California, and operators are responsible for collecting and remitting the tax to state entities [5][8].

- Regulations for Airbnb differ by city in California. Each city has its own set of guidelines and restrictions, ranging from bans to permits, taxes, and limitations on rental days. For example, Los Angeles requires hosts to obtain a home-sharing permit, register their listing, and adhere to specific requirements. San Francisco has stricter regulations, including limits on rental days and registration requirements. Other cities, such as Santa Monica, support a ban on rentals in the absence of the property owner but allow spare room rentals if the owner is present [4][6][7][11].

- Homeowner associations (HOAs) may have limitations or potential violations related to short-term rentals. It is essential to check for any restrictions that may apply to the property. Additionally, costs such as furnishing, cleaning, and bed taxes should be considered. Hosts should know that the income generated through Airbnb may not be considered stable or real income regarding property value, refinancing, or selling [4].

5. Marketing Plan for Your Airbnb

A good marketing plan should include research into the target market, property pricing, competitor analysis, and a method for creating a website, logo, and other business materials. Additionally, it should include PPC ads, email marketing, and partnerships.

Don’t have the budget for marketing? Here’s what I did:

- Discounted the first bookings of my condo

- Became a Superhost ASAP

- SEO optimized my Airbnb listing

- Branded my listing with a catchy name and description

6. Customer Acquisition on Airbnb

Here’s how to have a recession-proof Airbnb and get more bookings:

- Establish a customer service protocol – Establish a customer service protocol that includes responding to customer inquiries within an hour.

- Set competitive rates – Set competitive rates in your local market. Don’t be that greedy Airbnb with the massive cleaning fee. That super turns people off!

- Maintain a reasonable acceptance rate and an up-to-date booking calendar. This will help potential customers determine when your space is available and build up customer satisfaction stats.

- Offer amenities – Offer amenities that will enhance the customer’s experience. My condo has a full kitchen, cookware, washer/dryer, office area, tons of books and games, heated and cozy blankets, extra pillows, and emergency kits.

- In your Locals Guide, provide information about local attractions to help show off your region and promote return visits. I’m always happy to make recommendations to my guests to ensure they have a better stay – a better stay = a better rating.

7. Property Management for Your Rental Listing

When starting an Airbnb business, property management plays a vital role. Property managers or management companies can assist with various tasks to ensure a successful venture. They handle maintenance, support income goals, provide cleaning services, offer concierge assistance, and more. These services are particularly beneficial for owners with multiple properties or those pursuing Airbnb as a second career.

When hiring a property manager, expertise in the short-term rental business and a deep understanding of the local market and competition is crucial. Effective communication and project management skills are also essential, as guest relations management is a significant part of the job.

In addition to hiring a property manager, there are other ways to streamline your Airbnb business. A property management system (PMS) can automate repetitive tasks like guest communications and calendar management across multiple listing sites. Implementing smart locks, lights, and sensors can conserve energy, reduce utility costs, and enhance security when the property is unoccupied.

What I Do

I’m 31 as of 2023, and I started my Airbnb at about 27 with minimal disposable income. I did not want to pay a Property Management company, so I cleaned and repaired myself. When I decided to start traveling, I hired a housekeeper for $125 per clean. If an issue arises with my condo, I contact my HOA or housekeeper to arrange for a handyman to help me. Is this the most stress-free situation? No. But I pocket my income and don’t have to pay a 30-40% exorbitant management fee.

8. Property Maintenance

Starting an Airbnb business involves many maintenance considerations, including hiring a reliable team of local contractors. This team could include housekeepers, repairmen, plumbers, electricians, landscapers, accountants, and property managers. Along with responding quickly to booking inquiries and being available to answer guests’ questions during their stay, Airbnb hosts must keep the property clean and make any necessary repairs. They may also subcontract cleaning and maintenance to alleviate some of their hosting duties.

Rental Property Business

In addition, hosts should consider taxes, insurance, and licenses and make sure the property is fully furnished and repaired. Property management companies and rental property businesses can be hired to manage the rental space. In contrast, a local cleaning company should be contracted to clean the property before and after each guest.

What I Do

I take care of all property maintenance myself. Due to the remote nature of my condo, it costs an arm & a leg to get anyone out here. I’ll usually rent my condo and only see it for 4-6 months. When I return from my travels, I do a full inspection and fix anything, such as leaky faucets, filters, and more. For example, this winter, my condo was leaving from the ceiling due to the lack of snow removal above. Because of this, my back porch door is bloated and will not open. This does not impact my guests in the winter since they can’t access the porch because it’s completely snowed in, so I’m waiting until April/May for the HOA to fix this.

9. Airbnb Rental Income and Rental Rate

Calculating Airbnb income for a business is a simple process, but it does require some planning. Here are the steps to take to ensure that you are accurately calculating your Airbnb income:

- Set a rental rate. Decide how much you will charge for each night’s stay and any additional fees or taxes that may apply.

- Estimate your occupancy rate. Research the local market to determine how many nights your rental property will likely be occupied.

- Calculate your projected profits. Multiply the rental rate by your estimated occupancy rate to calculate your projected profits.

- Factor in any expenses. Calculate your estimated payments, such as mortgage interest, insurance, professional fees, property taxes, and other costs of running your Airbnb business.

- Subtract expenses from profits. Subtract your estimated expenses from your projected profits to determine your net Airbnb income.

- Review your results. Review your net Airbnb income and adjust as needed to maximize your profits.

My Take

My condo is seasonal, meaning people only book in the summer and winter. April, May, October, and November are practically empty. You need to consider seasons if you have a vacation rental. Last year, I made about $16,000 in the winter on my Airbnb (December 2nd – April 2nd).

10. Property Taxes & Regular Taxes

Taxes are a big deal when it comes to running an Airbnb business. You’ll also have sales taxes and a local occupancy tax to consider along with real estate taxes. The IRS recognizes Airbnb as a legitimate business, so keeping track of your income and expenses is crucial for your federal tax return. The good news is, you can deduct a ton of expenses from your Airbnb business, including utilities, property repairs, and cleaning services.

In some areas, Airbnb handles the collection and payment of occupancy taxes for hosts, saving you a lot of hassle. It’s wise to work with a tax professional to ensure you’re on the right side of the IRS. Additionally, you’ll need to open a business bank account and obtain a 1099-K form from Airbnb if your earnings exceed $20,000 or if you have over 200 transactions on the platform.

Come tax time (woohoo!); you can deduct various expenses, including Airbnb fees, ranging from 1-20% based on your rental’s nightly cost. It’s essential to research local tax requirements, understand the types of taxes you need to pay, and identify potential deductions you qualify for. Lastly, make sure to familiarize yourself with local laws to ensure your business complies with regulations.

I probably should have ironed these sheets, but this also creates a reasonable expectation with guests.

My 11 Personal Airbnb Tips

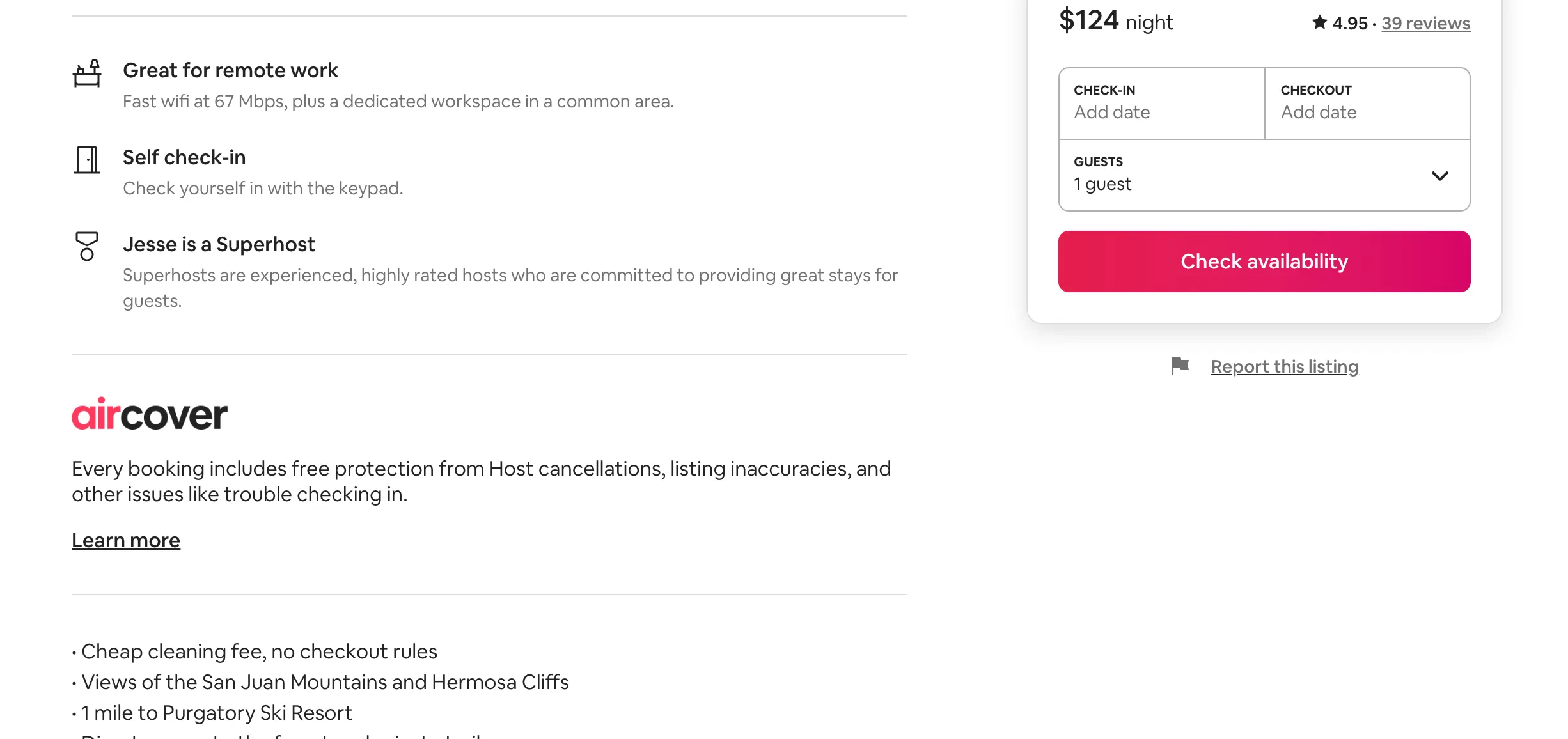

I have a 4.95 rating on Airbnb and have successfully removed two negative reviews. Aside from filling out your profile with all your fun details, you want to ensure your listing is in tip-top shape. Here’s how I maintain a successful Airbnb and keep my sanity and my guests happy:

Get a lockbox and hide a key somewhere inconspicuously.

Self-check-in is the only way to go, but if the battery dies, you want a backup.

Clean out your hot water heater once a year with vinegar.

This is especially important where I live because of the hard water. You don’t want the hot water to go out on a guest, and this will decrease the likelihood.

Make a list of bi-annual and annual chores. Here’s mine:

- Replace door battery – 9v.

- Check light bulbs.

- Flush hot water heater.

- Stock and chop wood.

- Resupply basic items.

- Replace the shower head filter.

- Set out mouse poison.

- Soak the shower head in vinegar.

Don’t be greedy.

No one likes exorbitant cleaning fees and other fees. Be reasonable and make it a win-win situation for you both.

- I keep my cleaning fee between $65-$95, but it costs me $125-$145.

- I incorporate the rest of the cost into the nightly fee.

Don’t overdo the checkout rules.

DO NOT ask your guests to do “check out” rules, like:

- stripping the sheets

- running dishes

- Sweeping and Mopping

It’s super tacky, and why are they paying you a cleaning fee? I always tell my guests to relax and check out at their leisure. That’s why I pay my housekeeper and tip her regularly.

Bullet points your key selling points in your description.

To do this, look at what people praise in the reviews.

- This is what they love the most.

- At my condo, it’s the location and amenities.

Don’t message your guests unless they message you during their stay.

Some will disagree with this, but the demographic on Airbnb (20-45) does not like being checked in with.

- It makes them feel as if they’re being watched or surveyed.

- Before they arrive, send a friendly message and tell them they can message you if they need anything.

- I go an extra step and tell them to let me know if they need anything on a dry-erase board.

Do not message a guest over minor incidents.

- Ripped sheets

- Stained towels

- Crumbs on the couch, etc.

This is the cost of business, and I promise you, it’s not worth the negative review you will get. Do not send them a fee. Ask Airbnb to cover it, or cover it yourself. Do not mention it to the guest. Secure the 5-star review and then you can leave an honest review about how they took care of your Airbnb so that future hosts can decide whether or not they want to host them.

Set expectations for their arrival and stay.

Ex: My listing says guests must have a 4-wheel drive in the winter due to snow and conditions. I have had guests complain about snow (yes, at a ski resort), and I refer them to the listing description. I always let guests know that there is gravel all over, and although it is unsightly, it is for their safety on the icy walkways. As long as you set expectations and communicate, it’s all recorded for your safety.

Don’t cry over your first bad review.

Don’t let it bother you too much. Not everyone can be pleased, and it’s not up to you to please all the Karens and Chads of the world. The best way to handle a negative review is to address their concern honestly and let anyone reading know how you will handle it from thereon out.

Keep all communication on the Airbnb App.

DO NOT let guests CALL OR TEXT you about issues. Please ensure it is done within the Airbnb app for your liability and records. If support needs to get involved, you can do so.

airbnb rental business

(My guests literally picked up all my rugs when it leaked – I gave them a huge refund).

Be fair and send refunds where applicable.

If something happens during your guest’s stay (leaking, broken things, etc.), send them a fair refund through the app. I promise you, it’s totally worth losing part of the income, and it will make them feel taken care of, and not leave a negative review.

- Ex: My condo recently leaked, and my guests had towels and buckets everywhere. I sent them $100 back for their $300 stay and gave them a huge list of travel recommendations for their departure. Another time, I legitimately had a mouse running around my condo even though I’d set up tons of traps, and I apologized to the guest and sent her some extra cash. Shit’s gonna happen. Wrap it into your costs and take care of your guests for any inconvenience.

Do take fun lifestyle photos of the condo.

I like to take photos of the workspace with my laptop, cute stuffed animals to be quirky, and coffee/kitchen setups. I also like to take photos of the surrounding areas because the mountains are breathtaking.

Don’t let guests who are flaky reschedule last minute.

They are likely trying to reschedule for later and then cancel to get a full refund. I recently had a guest message me two days before his arrival, stating he wanted to stay home and take care of snow (less than an inch). I told him I could not cancel his booking or would be penalized. He took the route of reaching out to Airbnb. Airbnb begged me to refund him, but I stood my ground. The guest did check in and did not trash the condo; he also left a good review. However, I’ve seen many instances where people try to change the date last minute and then cancel to get a full refund. You can decide if it’s worth it or not to deal with that because I’ll be honest, I was stressed about his review all weekend, but it turned out fine.

Airbnb Statistics in the US

- Airbnb experienced a significant recovery from the losses of 2020, with a 280.2% increase in net income in 2021.[1]

- The corporate revenue for the second quarter of 2022 reached $2.104 billion.[1]

- Airbnb’s valuation stood at over $70 billion as of August 2022.[1]

- The average host in the USA earned $13,800 in 2021.[1]

- Over 60% of U.S. hosts rent out their primary homes while on vacation.[1]

- There are over 4 million hosts with 6 million listings on Airbnb.[1]

- In the second quarter of 2022, Airbnb set a booking record with 103.7 million stays.[1]

- The gross booking value for Q2 2022 was $17.0 billion, representing a 27% increase year-over-year.[1]

- Airbnb’s biggest competitor in the online travel booking market is Booking.com.[1]

- Airbnb works with 8,700 third-party partners and has over 400 agreements with governments for tax collection.[1]

- Among guests, there is a growing trend of booking longer stays, with an average stay per booking increasing from 3.5 nights in 2019 to 4.1 nights in 2022.[1]

- 54% of Airbnb guests are female.[1]

- Over 60% of Airbnb hosts in the USA are women.[1]

- Airbnb offers unique stays across various categories, including cabins, farms, tiny homes, and campers.[1]

- Airbnb Experiences, including virtual activities, have become popular, and hosts earn an average of $10,000 annually.[1]

2023 Updates to Airbnb for Hosts

- Airbnb Rooms: Guests can stay with local hosts in over 1 million private bedrooms with shared spaces. Host Passports provide host information. [1]

- Total Price Display: Guests can see the total price of their stay, including fees, before taxes. [2]

- Transparent Checkout Instructions: Checkout instructions are built-in and transparent for guests. [2]

- Improved Maps: Enhanced maps with mini-pins and better search autocomplete. [2]

- Redesigned Wishlists: Wishlists have a new interface, larger images, and added functionality. [2]

- Monthly Stays: Reduced fees for monthly stays, with the option to pay by bank account. [8]

- Klarna Partnership: Guests in the US and Canada can pay in installments through Klarna. [8]

- Enhanced Hosting Tools: Redesigned pricing tools, improved calendar views, and simplified co-host invitations. [11]

- Identity Verification and Safety Enhancements: Stronger guest identity verification, increased damage protection, and simplified claim filing. [2]

Good luck with your new Airbnb listing!

I hope you found this article helpful and feel more comfortable starting an Airbnb. If you have any questions, don’t hesitate to reach out :)